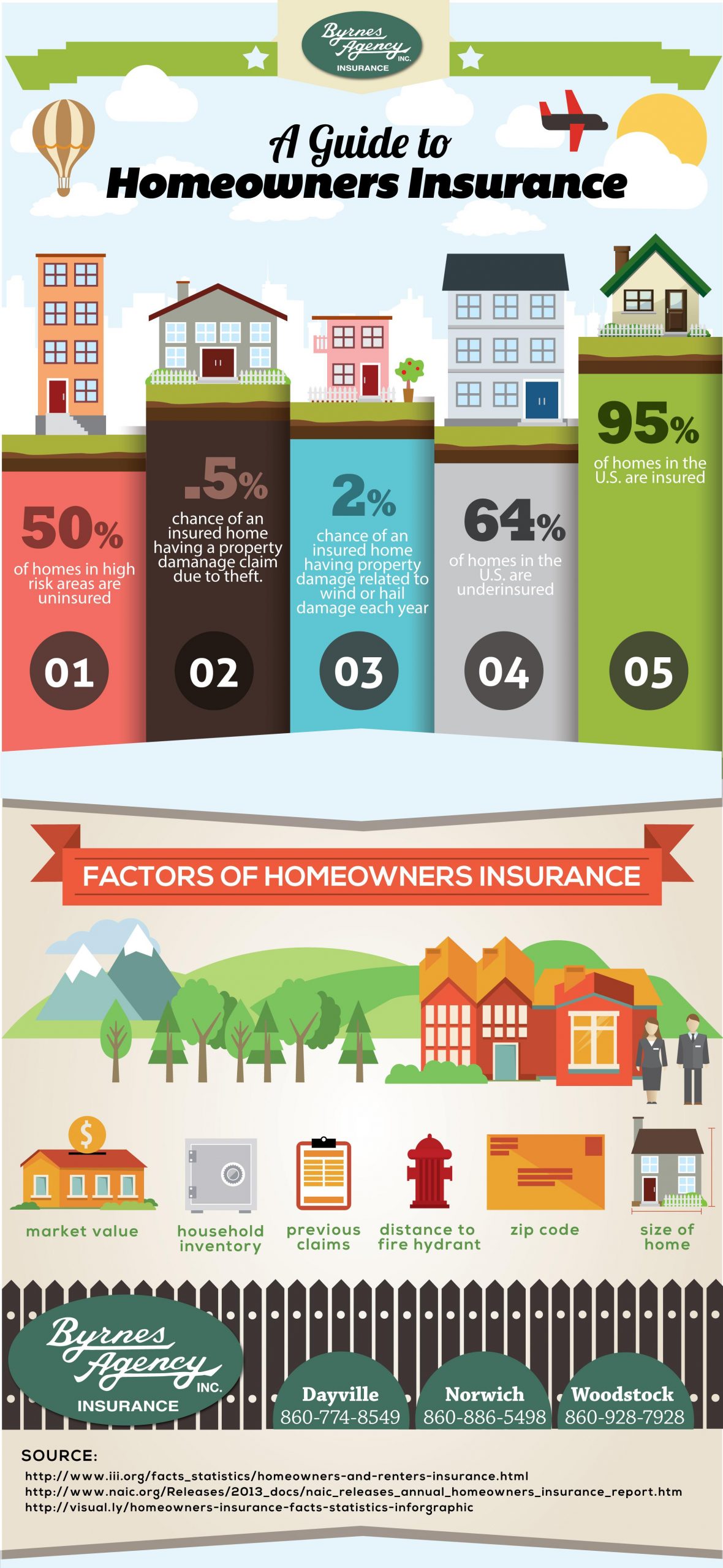

Connecticut Homeowners Insurance Infographic

Connecticut Homeowners Insurance Infographic

Connecticut homeowners look to the Byrnes Agency for proper insurance coverage in the event of damage or liability. We are extremely honored that so many residents trust us with one of their most valuable assets.

Within a Homeowners Insurance policy, there are many coverages that can be included with your insurance policy.

Personal Liability

We’ll help you determine the preferred amount of Personal Liability coverage to include in your policy. This amount may vary according to the value of any assets you may own.

Replacement Value of Your Home

We can add extended Replacement Cost coverage to your policy to ensure that your home is rebuilt to the same standards used in the original construction. The quality of materials will be the same, and your house will look as close as possible to what it was before the loss.

Amount of Personal Property Coverage

We can add replacement value coverage that ensures full replacement of your personal property — with no deduction for depreciation that may have occurred. We recommend that your personal property coverage include all-risk coverage. We also suggest that you insure expensive possessions such as jewelry, collectibles, or art separately.

Special Coverages

Many homeowners have high-risk assets such as fences, pools, sheds, etc. that are covered only minimally by a standard Homeowners policy. We’ll help you make sure the policy covers you adequately.

We hope that you choose Byrnes Agency as your local insurance resource. Please if you have any questions, give us a call to any of our 3 Connecticut Insurance offices.

Tags: connecticut, connecticut homeowners insurance, Connecticut Homeowners Insurance Infographic, ct, Home, Homeowners, Homeowners Insurance Infographic, Infographic, Insurance, Insurance Infographic, New London, Windham